Early in my trading career, I made every decision on a single chart. I'd open M5, slap on some indicators, and trade whatever signal appeared. When it worked, I felt like a genius. When it failed — which was more often — I blamed the indicator.

The indicator was never the problem. The problem was that I was trading M5 signals without any context about what the bigger picture was doing. It's like trying to navigate a city by looking at the ground under your feet instead of checking the map first.

Multi-timeframe analysis (MTF) fixed this. Not in a theoretical "I read about it in a book" way, but in a practical "my win rate improved measurably when I started doing it" way. Here's the exact process I follow.

The Concept: Each Timeframe Answers a Different Question

The key insight that changed everything for me: each timeframe in your analysis should answer one specific question. When you try to get all your answers from one timeframe, you set yourself up for confusion.

- H4 answers: "What is the dominant trend direction?" (The compass)

- H1 answers: "Where is the market structure right now?" (The map)

- M15 answers: "Is this a good time to look for entry?" (The clock)

- M5 answers: "Where exactly do I enter and place my stop?" (The trigger)

If all four timeframes are telling the same story — bullish trend, bullish structure, bullish timing, bullish trigger — you have a high-probability trade. If they're contradicting each other, you wait.

Step 1: H4 — Finding the Compass Direction

I start every session by looking at the H4 chart. This is not where I trade from — it's where I establish my directional bias. The question I'm answering: should I be looking for longs or shorts today?

What I look at on H4:

- EMA ribbon direction: Is the ribbon expanded and ordered? Green (bullish) or red (bearish)?

- Price relative to ribbon: Is price above or below the ribbon cloud?

- Recent candle structure: Are the recent candles making higher highs/higher lows (uptrend) or lower highs/lower lows (downtrend)?

Decision rules:

- H4 ribbon expanded green + price above → I only look for longs today.

- H4 ribbon expanded red + price below → I only look for shorts today.

- H4 ribbon compressed or twisted → No trading today. The bigger picture is unclear.

This step takes about 10 seconds. I'm not analyzing candle patterns or drawing Fibonacci levels on H4. I'm just getting a directional read — north or south. That's all I need from this timeframe.

Step 2: H1 — Reading the Structural Map

Once I have my H4 bias, I drop to H1. This is where I look for market structure — swing highs, swing lows, and whether the current price is at a meaningful level.

What I look at on H1:

- Recent swing points: Where are the last 2-3 swing highs and swing lows?

- Structural context: Is price in the middle of a range, or approaching a key high/low?

- EMA ribbon state: Does H1 ribbon agree with H4 direction?

The goal here is to identify where I should and shouldn't trade. If H4 is bullish but H1 shows price sitting right at a major resistance level, I'm going to be cautious about taking longs into that resistance. I'd rather wait for a break-and-retest.

Conversely, if H4 is bullish and H1 shows price has just pulled back to a support level with the ribbon still ordered bullish, that's a high-quality zone to start looking for entries on the lower timeframes.

Step 3: M15 — Checking the Clock

M15 is my timing filter. It tells me whether right now is a good time to start looking for entries, or whether I should wait.

What I look at on M15:

- Ribbon state: Is the M15 ribbon expanding in the direction of my H4 bias?

- Momentum: Are the candles showing momentum (strong bodies, minimal wicks) or hesitation (doji candles, long wicks)?

- Session context: Am I within my active trading window?

Decision rules:

- M15 ribbon expanding in H4 direction + momentum candles → Go to M5 for entry.

- M15 ribbon compressed → Wait. The market hasn't committed yet.

- M15 ribbon expanding against H4 direction → Counter-trend pullback in progress. Wait for it to finish before looking for entries.

This step filters out a lot of bad trades. Sometimes H4 is clearly bullish, H1 structure is supportive, but M15 is showing a counter-trend move in progress. Without this step, I'd enter too early and get stopped out during the pullback.

Step 4: M5 — Pulling the Trigger

Only when H4, H1, and M15 all agree do I switch to my execution timeframe — M5. This is where I look for the actual entry signal.

On M5, I use the EMA ribbon pullback setup: wait for a pullback into the ribbon followed by a rejection candle. My stop loss goes below the ribbon's slowest EMA (or above it for shorts).

Because I've already confirmed the direction on three higher timeframes, I'm not asking M5 to tell me which way to trade. I already know. M5 only needs to tell me the optimal entry point.

This is a critical distinction. Most traders overload their M5 chart with directional analysis that should be done on higher timeframes. When your M5 chart is only responsible for timing, your indicators become much more effective.

Real Example: How This Plays Out

Let me walk through a hypothetical (but very typical) morning:

07:30 GMT — H4 check: Gold H4 ribbon is expanded green. Price is well above the ribbon cloud. The last three H4 candles made higher lows. Verdict: strong bullish bias. Only looking for longs.

07:35 GMT — H1 check: H1 shows price pulled back from a recent high and is sitting near a horizontal support level where the H1 ribbon is. The ribbon is still ordered bullish. Verdict: price is in a good zone for continuation — not overextended.

08:00 GMT — M15 watch: London has just opened. M15 ribbon was compressed during Asian session but is now starting to expand green. Momentum candles are appearing. Verdict: timing is getting favorable.

09:15 GMT — M5 entry: After the initial London move, price pulls back into the M5 ribbon on a red candle, touches the EMA 21, and then a green engulfing candle prints. I enter long on the close of that candle. SL below EMA 55. TP at the H1 resistance level I noted earlier.

Total analysis time: under 5 minutes. Trade management time: 20-30 minutes. The trade either hits TP, trails to breakeven, or stops out — all predefined before entry.

Common Mistakes in Multi-Timeframe Analysis

Using too many timeframes. Some traders check D1, H4, H1, M30, M15, M5, and M1. That's seven timeframes. By the time you've analyzed all of them, you've either confused yourself or the setup is gone. Four timeframes is the sweet spot — direction, structure, timing, execution.

Looking for agreement on every minor detail. The higher timeframes don't need to show the exact same pattern as the lower ones. They need to agree on direction. H4 bullish and M5 bullish is agreement. H4 bullish with a current H4 red candle doesn't automatically mean disagreement — it might just be a healthy pullback within a bullish trend.

Changing bias mid-session. Once I've established my H4 bias at the start of the day, I don't change it. Even if M5 shows a strong bearish move, I don't flip to short if H4 is still clearly bullish. That bearish M5 move is a pullback within the bigger uptrend — exactly the kind of move I want to fade, not follow.

Starting analysis from the lowest timeframe. Always go top-down: H4 → H1 → M15 → M5. If you start at M5 and work up, you'll develop a bias based on the M5 noise and then seek confirmation on higher timeframes (confirmation bias). Top-down analysis prevents this.

Tools That Help

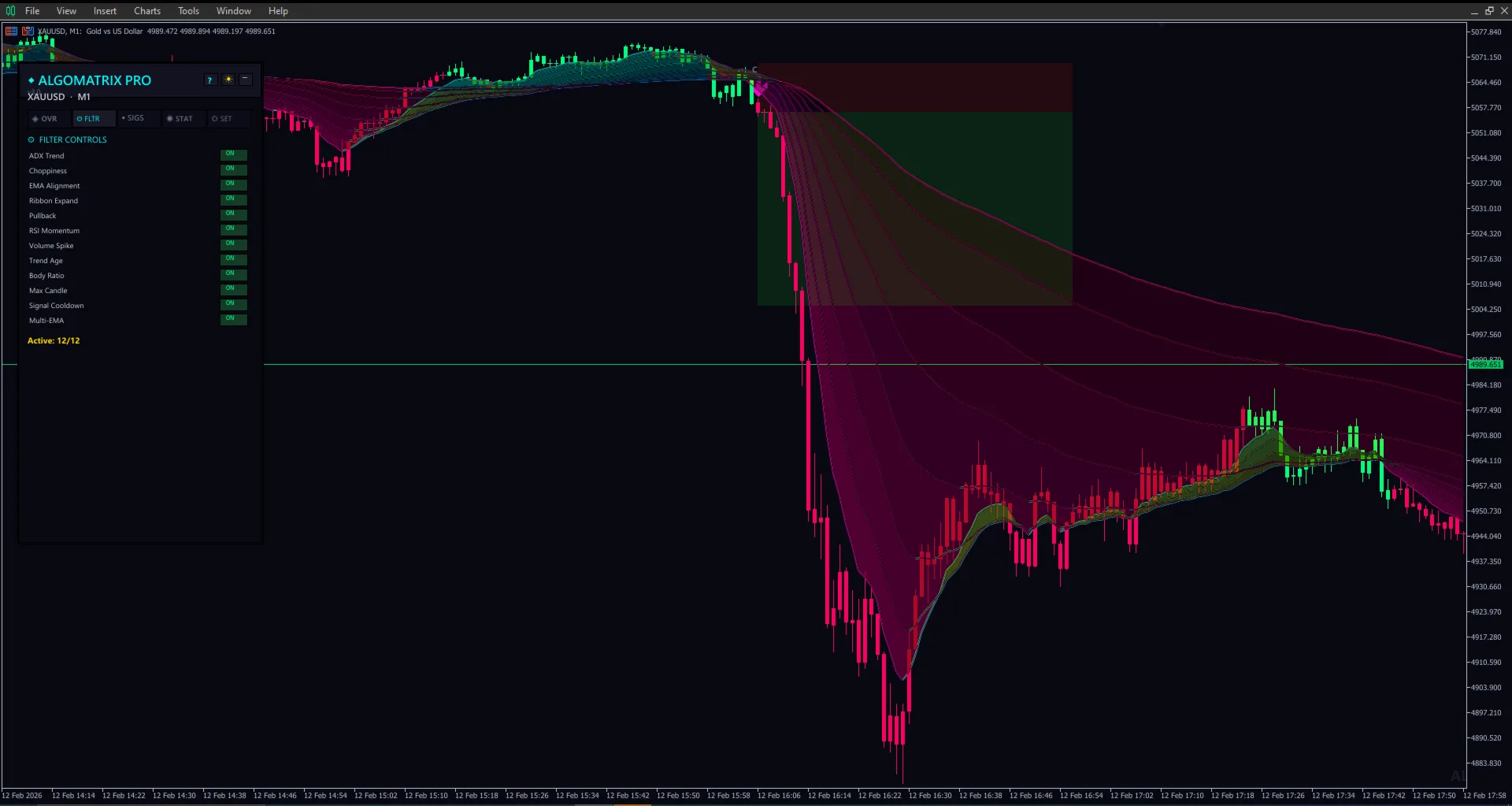

I built my Multi Scanner Pro indicator to speed up this process. It shows the EMA ribbon state, trend direction, and momentum across multiple timeframes in a single dashboard panel — so I don't have to manually flip through four chart windows every morning.

For the ribbon itself, EMA Ribbon Trend Pro works on any timeframe and any symbol. You can keep it on multiple chart windows and visually compare ribbon states across timeframes.

The One-Minute Version

If you only take one thing from this article, take this:

Before every trade, answer four questions in order:

- H4: Which direction? (If unclear → no trade)

- H1: Am I at a sensible level? (If overextended → wait)

- M15: Is momentum building in my direction? (If not → wait)

- M5: Is there a clean entry signal? (If not → wait)

If the answer to any question is "no" or "unclear" — don't trade. Wait. Patience is the most profitable skill in trading, and multi-timeframe analysis gives you a structured framework for exercising it.

Disclaimer: This article describes my personal analysis process and is not financial advice. Past results and strategies do not guarantee future performance. Always trade with proper risk management.