I've bought over 40 indicators in my trading career. I've also built 12 of my own. And here's what I wish someone had told me at the start: the right indicator isn't the one with the best backtest or the most features. It's the one that matches how you actually trade.

This sounds obvious, but most traders get it backwards. They find an indicator, learn its signals, and then try to adapt their personality and schedule to match the tool. That's like buying shoes first and then hoping your feet grow into them.

Let me walk you through how to actually match an indicator to your trading style — using practical categories that matter, not marketing buzzwords.

First Question: What Kind of Trader Are You?

Before discussing any indicator, you need to honestly answer this. And "I want to be a scalper who also swing trades with occasional position trades" isn't an answer — that's indecision masquerading as flexibility.

Scalper (5-30 minute trades)

You sit at the screen during specific sessions. You want quick entries and exits. You're comfortable with a high number of trades per session — maybe 3-8. You prefer M1 to M15 charts. You don't want to hold positions overnight. You need fast decision-making tools that show you momentum and microstructure.

Intraday Swing (1-8 hour trades)

You catch the bigger moves within a session or across sessions. You're okay holding through some noise. You typically trade M15 to H1. You might take 1-3 positions per day. You need tools that show you structure, levels, and trend direction rather than tick-by-tick momentum.

Swing Trader (1-5 day trades)

You analyze charts once or twice per day. You trade H1 to D1. You're looking for structural moves. You don't mind overnight or multi-day holds. You need tools that show higher-timeframe trends, key levels, and reversal patterns rather than short-term momentum.

Trend Follower

You want to identify a direction and ride it for as long as it lasts. You enter on pullbacks within the trend. You're okay with late entries because you're not trying to catch tops and bottoms. You need tools that clearly show trend direction, strength, and pullback depth without noisy signals.

Reversal/Counter-Trend Trader

You look for exhausted moves and trade the turn. You enter at extremes — overbought, oversold, key structural levels. You need tools that identify overextension, divergences, and institutional zones where reversals are likely.

Most traders are a blend, but one style dominates. Identify your dominant style — that determines what kind of indicator information you need most.

Indicator Categories — What Each Type Actually Tells You

Indicators fall into functional categories. Understanding these categories matters more than brand names or product features.

Trend Indicators

What they tell you: Which direction price is moving and how strong the trend is.

Examples: Moving averages, EMA ribbons, Ichimoku cloud, SuperTrend, ADX.

Best for: Trend followers and anyone who wants to trade with the dominant direction.

Weakness: Late entries (they confirm after the move starts) and terrible in ranging markets (generate whipsaw signals).

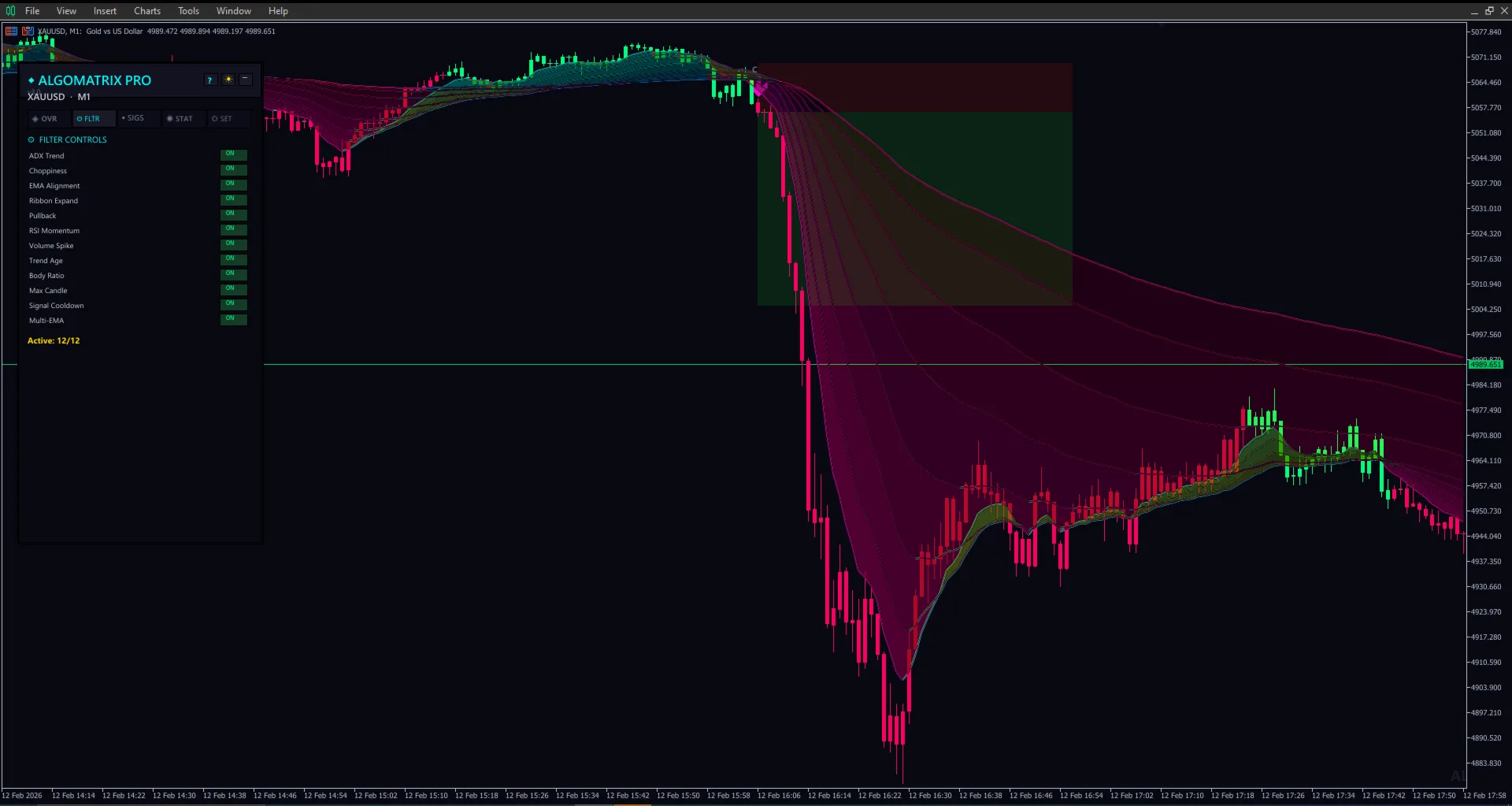

If you're a trend follower or intraday swing trader, your primary indicator should be trend-based. I'm biased here — I built AlgoMatrix EMA Ribbon Indicator precisely because I'm primarily a trend trader, and I wanted a multi-layer ribbon that shows not just direction but the quality of the trend through ribbon spread and alignment.

The EMA ribbon approach specifically tells you something a single moving average can't: when short-term and long-term momentum are aligned. If all ribbon layers are stacked and expanding, you're in a strong trend. If they're tangled, you're in chop. This distinction alone keeps you out of most bad trades.

Momentum/Oscillator Indicators

What they tell you: Speed of price movement, overbought/oversold conditions, potential exhaustion.

Examples: RSI, MACD, Stochastic, CCI, wave-based momentum tools.

Best for: Scalpers looking for entry timing within an established direction, and reversal traders looking for exhaustion signals.

Weakness: In strong trends, oscillators can stay overbought/oversold for extended periods, generating premature reversal signals.

For scalping momentum on gold, I built Wave Rider Pro to capture the three-wave momentum pattern that gold often shows — impulse, correction, extension. It's not a traditional oscillator; it reads momentum through wave structure rather than mathematical formulas, which I've found more reliable for gold's behavior.

Structure/Level Indicators

What they tell you: Where important price levels are — support/resistance, supply/demand zones, order blocks, pivot points.

Examples: Fibonacci tools, pivot points, S&D zone indicators, order block markers, ZigZag-based structure tools.

Best for: All trading styles, but especially swing traders and reversal traders who trade from levels rather than momentum.

Weakness: Zones and levels are areas, not precise prices. Without confirmation from momentum or price action, trading levels alone leads to catching falling knives.

This is where Supply & Demand Zone Pro and Order Block Sniper Pro fit. They map the structural landscape — where institutional orders are likely sitting. You don't trade these levels blindly; you use them to know where to look and then use momentum or price action confirmation to time the entry.

Signal Indicators

What they tell you: Specific entry/exit points — buy here, sell here, with arrows or alerts.

Examples: Buy/sell signal generators, alert-based crossover systems, multi-condition signal tools.

Best for: Traders who want clear, actionable signals and don't want to interpret multiple confluences manually.

Weakness: Signal quality varies enormously. Repainting signals are a huge risk. And following signals without understanding the logic behind them means you can't adapt when market conditions change.

My Buy Sell Signal Pro falls in this category — it generates non-repainting buy/sell arrows based on multi-condition confluence. But I always tell buyers: use it with at least a basic understanding of trend direction. Signals against the trend have lower probability regardless of how good the indicator is.

Session/Time Indicators

What they tell you: Which trading session is active, session ranges, time-based volatility patterns.

Examples: Session highlighters, kill zone markers, session range indicators.

Best for: Gold and forex traders who need to understand when volatility and liquidity change based on session openings and closings.

Weakness: They provide context, not signals. They tell you when to be alert, not what to do.

For gold specifically, session context is extremely important — the same setup has dramatically different probability depending on whether it occurs during Asian session versus London session. Gold Session Sniper Pro is built specifically for this — marking session boundaries, ranges, and highlighting optimal trading windows on XAUUSD.

Multi-Pair/Multi-Timeframe Scanners

What they tell you: Conditions across multiple instruments or timeframes at a glance, without manually switching charts.

Examples: Dashboard scanners, heatmaps, multi-chart condition monitors.

Best for: Traders who monitor multiple pairs or need quick multi-timeframe confirmation.

Weakness: Information overload if you're not disciplined about which signals matter. Dashboard paralysis is real.

I use Multi Scanner Pro to quickly see EMA ribbon alignment across timeframes and pairs without switching charts. It's a time-saver during my pre-market routine, not a signal source.

Trade Management Tools

What they tell you: Nothing — they don't analyze the market. Instead, they manage your open positions automatically.

Examples: Trailing stop tools, partial close managers, breakeven utilities, risk calculators.

Best for: Every trader who has ever closed a trade too early or held too long. Also essential for traders who trade multiple positions.

Weakness: They manage according to rules — if your rules are wrong, they'll consistently execute bad management.

Smart Trade Manager Pro handles my multi-level exits and trailing stops. This isn't about market analysis — it's about execution discipline, which is where most traders leak money even when their entries are good.

Matching Style to Indicator Stack

Here's my recommended starting stack for each trading style. Notice: no style uses more than 3 tools. More than 3 creates analysis paralysis and conflicting signals.

Scalper on M5 Gold

- Primary: EMA ribbon or trend indicator for direction filter

- Secondary: Signal or momentum indicator for entry timing

- Support: Session indicator to know when volatility is optimal

Real example from my setup: Gold EMA Ribbon Scalper Pro (trend + signals combined for M5 gold scalping) + Gold Session Sniper Pro (session context).

Intraday Swing Trader

- Primary: Multi-timeframe trend indicator (H4/H1/M15 alignment)

- Secondary: Structure indicator (S&D zones or order blocks) for key levels

- Support: Trade manager for partial exits and trailing stops

Real example: EMA Ribbon Trend Pro (trend across TFs) + Supply & Demand Zone Pro (levels) + Smart Trade Manager Pro (exit management).

Reversal/Counter-Trend Trader

- Primary: Structure indicator (order blocks, S&D zones)

- Secondary: Momentum or oscillator tool for exhaustion confirmation

- Support: ZigZag or structural swing indicator for pattern identification

Real example: Order Block Sniper Pro (institutional reversal zones) + Wave Rider Pro (momentum exhaustion) + ZigZag Scalper (structural patterns).

Trend Follower

- Primary: EMA ribbon or strong trend indicator

- Secondary: Multi-timeframe scanner for alignment confirmation

- Support: Trade manager with trailing stop for riding trends

Real example: AlgoMatrix EMA Ribbon Indicator (deep trend read) + Multi Scanner Pro (MTF alignment) + Smart Trade Manager Pro (trailing stop management).

The Indicator Stack Trap

The biggest mistake I see — and made myself for over a year — is loading 6-8 indicators on a chart and waiting for all of them to agree. This almost never happens, and when it does, you've missed half the move waiting for the last indicator to confirm.

Here's the truth: indicators built from the same input data (price) will often contradict each other because they measure different things. Your RSI might say overbought while your EMA ribbon is strongly bullish. That's not a bug — they're measuring different aspects of the market.

The solution is to assign each indicator a specific job:

- One indicator tells you the direction (trend indicator)

- One indicator tells you WHERE to look (structure/levels)

- One indicator tells you WHEN to enter (signal/momentum confirmation)

If two of your indicators are doing the same job (e.g., both telling you direction), remove one. Redundancy doesn't increase accuracy — it just creates confusion when they disagree.

What About Free Indicators?

There are excellent free indicators on MQL5 and built into MT5. RSI, MACD, standard moving averages, ZigZag — these are genuinely useful tools that cost nothing. So why buy premium indicators?

Honestly, you don't need to. If you're a beginner, learn with free tools first. Understand what moving averages do, how RSI works, what ZigZag shows you. Build your trading foundation with free tools and don't spend money until you understand what specific problem you need solved.

Premium indicators add value in two ways: they combine multiple analyses into a single visual (saving time and reducing chart clutter), and they're customized for specific use cases (like gold scalping on M5 specifically, rather than being generic tools that work "on all instruments").

My indicators are built for specific jobs on specific instruments because that's how I trade. A generic "works on everything" indicator has to make compromises — a gold-specific indicator doesn't. But if you're not trading gold, or not trading the style the indicator is built for, the premium doesn't help you.

Red Flags When Choosing Indicators

After buying over 40 indicators (many of which were disappointing), here are red flags I've learned to watch for:

- "100% accurate signals" — Doesn't exist. Any indicator claiming this is either lying or repainting.

- Only showing winning trades in screenshots — Ask for a full session screenshot including losses. If the seller won't provide one, the indicator can't handle real market conditions.

- "Works on all timeframes and instruments without adjustment" — Physics of M1 scalping and D1 swing trading are fundamentally different. An indicator that works on both without parameter changes is likely mediocre on both.

- No clear explanation of what the indicator calculates — "Secret algorithm" or "AI-powered neural network" without specifics means you can't evaluate whether the logic is sound or adapt your usage when conditions change.

- Cluttered charts in screenshots — If the indicator screenshot looks like modern art with arrows, lines, zones, and colors everywhere, the indicator is trying to do too many things. Clean chart = clear thinking.

- No demo version or trial period — On MQL5, most indicators offer a free demo. If they don't, ask why. I give demos on all my products because hiding the product before purchase doesn't make sense.

My Honest Recommendation

Start with one indicator — the one that matches your primary trading style. Learn it deeply. Trade with it for at least a month on demo. Understand its strengths and weaknesses. Only then add a second indicator to cover a gap the first one doesn't address.

If you're trading gold and you're primarily a trend-following scalper, start with an EMA ribbon tool. If you're a reversal trader, start with an S&D zone or order block tool. If you just want clear entry signals and are still building your analysis skills, start with a clean signal indicator.

The right indicator won't make you profitable. Good risk management, a consistent routine, and emotional discipline make you profitable. But the right indicator can make the journey faster and less painful by giving you clear, relevant information at the right time.

And the wrong indicator — one that doesn't match your style — will actively make you worse by generating signals you shouldn't follow and creating confusion where there should be clarity.

Choose carefully. And if you're not sure where to start, take a step back and answer the first question in this article first: what kind of trader are you?

Disclaimer: This article reflects my personal views on indicator selection based on trading experience and is not financial advice. All trading involves risk. Indicator performance depends on strategy, market conditions, and the trader's own skills. Demo-test any tool before using it with real capital.